EXCITING NEWS: TNG WhatsApp Channel is LIVE…

Subscribe for FREE to get LIVE NEWS UPDATE. Click here to subscribe!

The Deputy President of the Senate, Senator Ovie Omo-Agege Wednesday said Nigeria has lost a total of $235 billion to delay in the passage of the Petroleum Industry Bill (PIB).

According to him, the nation loses $15bn yearly to the delay.

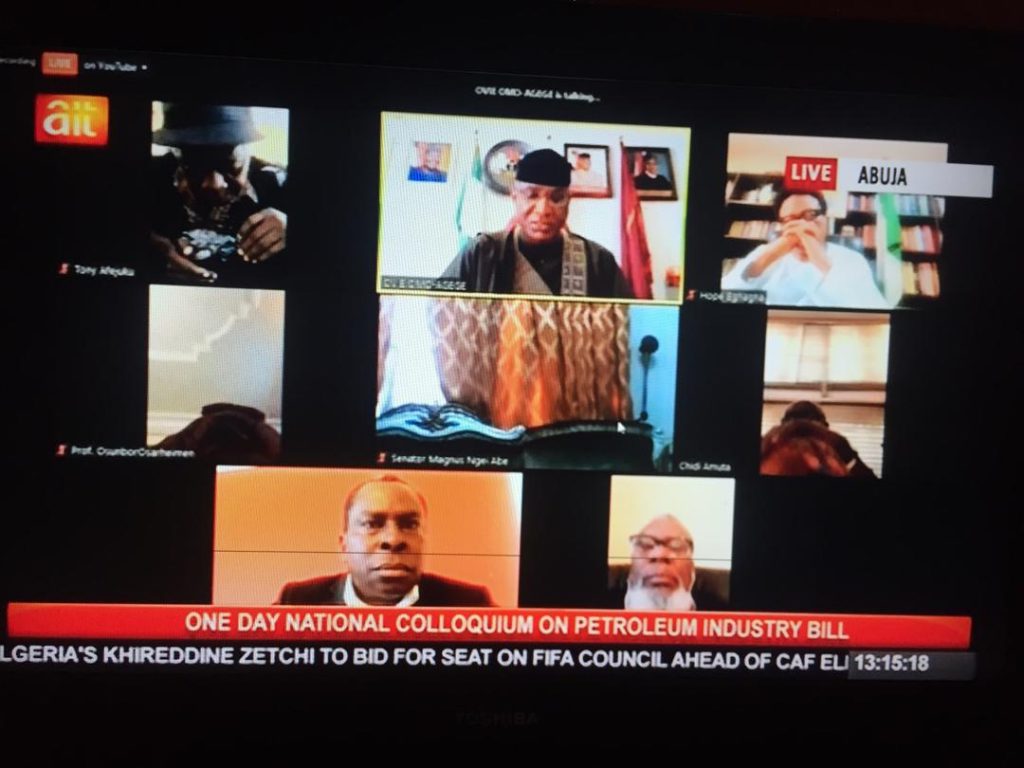

The Deputy Senate President said this in his keynote address during the #TNGPIBConfab held virtually on Wednesday.

Omo-Agege explained that before the pandemic and oil slump, the petroleum industry was the backbone of the Nigerian economy. According to him, it is the highest contributor to the national wealth, accounting for about a third of our GDP, over 75 percent of government revenues and 95 percent of foreign exchange earnings.

“Now, it is estimated that Nigeria loses $15 billion annually as a result of the delay in passing the PIB. According to a report by Nigeria Natural Resource Charter (NNRC) the delays,through different administrations, in enacting the PIB have cost the country an estimated $235 billion.

Advertisement

All these underscore the urgent need to do what we should have done in 2008 to give Nigeria the great oil industry it deserves, when President Umaru Musa Yar’Aduasaw the need to overhaul the existing petroleum laws. These include the Petroleum Act of 1969, the Petroleum Profit Tax Act of 1959, and the Nigerian National Petroleum Corporation (NNPC) Act 1977, among other legislations,” he said.

Highlighting the inputs of the President Muhammadu Buhari led administration and ninth National Assembly to pass the bill, Omo-Agege said:

The good news today is that help is on the way, as the 9th Assembly and the government of President Muhammadu Buhari, have boldly taken up the gauntlet and will soon enact the Petroleum Industry Bill 2020 into an Act.On the 29th of September last year, the government of President Muhammadu Buhari took a giant step forward in reforming the industry when he returned the Petroleum Industry Bill as an executive Bill to the National Assembly.

Subsequently, the Bill was read for the first time on the 30th of September, 2020, second reading on 20th of October, 2020 and public hearing was held on 27th January this year.Now we await the report on the public hearing from the Senate’s committees namely: Petroleum Downstream, Petroleum Upstream and Gas Committee, to be put forward for consideration by the Senate.

Through this Bill, the president plans to provide a framework to boost oil and gas output while enhancing sector attractiveness for international investors, thus increasing foreign direct investment. He also plans to streamline and reduce some oil and gas royalties, with the underlying objective to encourage international operators to invest in exploration and production, taking advantage of Nigeria’s extensive petroleum reserves.

Dissecting the PIB and what Nigerians in generally stand to gain after passing it, the lawyer turned lawmaker said:

“The Bill also looks to drive environmental clean-ups and other green initiatives, gas monetization, including measures to encourage companies to explore and produce gas from discoveries, as well as a framework for gas tariffs and delivery.

Essentially, the present PIB is founded on two main pillars. The first is to run the Nigeria National Petroleum Corporation (NNPC) as a business enterprise by transforming it into a private limited liability company – NNPC Limited. This will be followed by the scrapping of the Petroleum Product Pricing Regulatory Agency (PPPRA).

This approach is consistent with what is today’s best practice as we see in organizations such as Aramco in Saudi Arabia. The Saudi national oil company was floated on the country’s stock exchange in 2019, with the Initial Public Offer (IPO) raking-in $29billion. There is also Petrobras (PetróleoBrasileiro S.A.) in Brazil, Equinor in Norway, and Petronas in Malaysia. NNPC will be open to private capital and will drop the Minister of Petroleum from the Board of the organization. This is a clear demonstration as to the extent the reforms intend to go.The second pillar is to establish separate regulatory authorities for the operations of the upstream, midstream and downstream sectors. These are the Upstream Regulatory Commission and the Nigerian Midstream and Downstream Petroleum Regulatory Authority. The “Commission” will replace the DPR and the Petroleum Inspectorate. The “Authority” will replace the Petroleum Products Pricing Regulatory Agency and the subsidy body, the Petroleum Equalisation Fund will cease to operate.Both regulatory bodies will be self financing, but while the Commission will be funded through the appropriation of an unspecified share of its revenues, the Authority’s funding, also via appropriation, will be based on a 1% charge on the wholesale price of petroleum products sold in Nigeria.

The PIB also seeks to decrease the royalty rate for offshore fields producing a maximum of 15,000 barrels per day to 7.5% from the current 10%. It also looks to raise the royalty threshold of crude oil price to $50 per barrel from $35 per barrel; reduce petroleum profit tax for onshore fields to 72.5% from 85% and decrease royalty payments to 18% from 20%. It will also discourage gas flaring by making its penalties non-tax deductible.

When passed into law, this landmark Bill will enhance competitiveness in the sector, aid the deregulation of the oil sector and help attract more investment, especially Foreign Direct Investment (FDI) into Nigeria. This will no doubt increase the contribution of this sector to the country’s economy. More FDI inflow will surely boost external reserves and strengthen the naira against foreign currencies.”